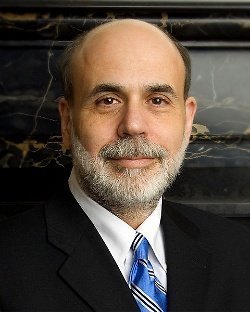

We did stop the meltdown. We avoided what would have been, I think, a collapse of the global financial system. That was obviously a good thing. But one thing that I was always sure of and the Federal Reserve was always sure of was that a collapse of some of these big financial firms was going to have very serious collateral consequences. There were people arguing even as late as September 2008, Well, why don't you just let the firms collapse? There is a system that can take care of it: bankruptcy. Why don't you let them fail? We never thought that was a good option. Particularly, if the whole system had collapsed, we would have had extraordinarily serious consequences.

Lecture 3: The Federal Reserve's Response to the Financial Crisis - The Federal Reserve and the Financial Crisis (2012)